Why Your Family Can’t Afford to Go Without Life Insurance

Nothing breaks my heart more than seeing the aftermath of a tragedy strike a family who didn’t prepare. It’s gut-wrenching to watch a GoFundMe page become the last, desperate act of financial survival for those left behind. That’s why I’m here today, speaking to you as both a professional and as a fellow parent. Let’s talk honestly about why life insurance isn’t a luxury – it’s a necessity for your family.

| The Cold, Hard FactsYou see, life doesn’t always work the way we want it to. Accidents happen – to adults and, sadly, even to our precious children. Sometimes, serious illnesses strike, and the financial burden can be as devastating as the diagnosis itself. That 401k from your job? While a wonderful benefit, it’s rarely enough to weather a major financial storm. The truth is, those you hold dearest are counting on you to create a safety net if the worst happens. |

What IS Life Insurance, and How Can I Choose?

Life insurance is essentially a contract between yourself and an insurance company. You pay your premiums, and in return, your chosen beneficiaries receive a lump-sum, tax-free payout (called a “death benefit”) when you pass away. This can cover funeral costs, outstanding bills, mortgages, your children’s education…it’s the way you protect them even when you’re no longer physically there.

Here are some policy types worth considering:

- Term (Return of Premium) Policies: These are the most affordable options. They provide coverage for a chosen period, say 10, 20, or 30 years. An awesome feature of “Return of Premium” policies is that if you outlive the term, you get all your premiums back!

- Accidental Death Insurance: These policies are meant to cover unexpected tragedies, just like the name says. While not the same as a comprehensive life insurance plan, they add a layer of protection at very low rates.

- IUL (Indexed Universal Life): This type of policy not only provides a death benefit but also has a cash value component that can grow over time, potentially offering additional financial benefits down the line.

- Critical Illness Insurance: These policies pay out if you or a child are diagnosed with a serious illness like cancer, heart attack, stroke, high blood pressure, Alzheimer’s Disease, paralysis and more. It provides a lifeline when medical bills mount up and income is strained.

Protecting Your Children: Why It’s Never Too Early

Now, this part might hit hard, but it’s a conversation we need to have. Insuring your children is an act of love. No parent ever wants to think of their child’s life ending prematurely, but it happens. A child’s policy can help cover the unimaginable costs of a funeral, as well as grief counseling and lost wages if a parent needs extended time away from work. It ensures a financial burden doesn’t worsen an already unbearable loss.

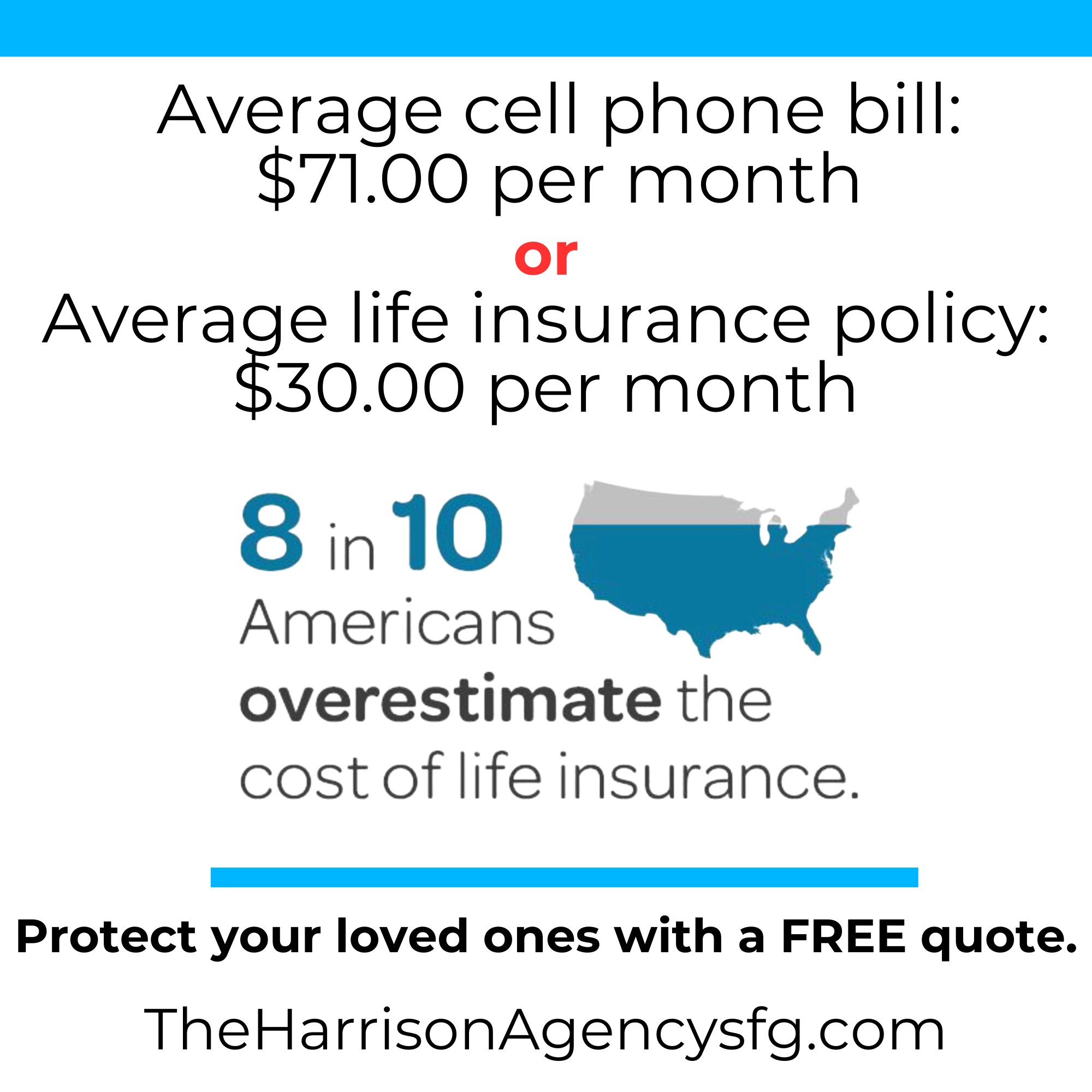

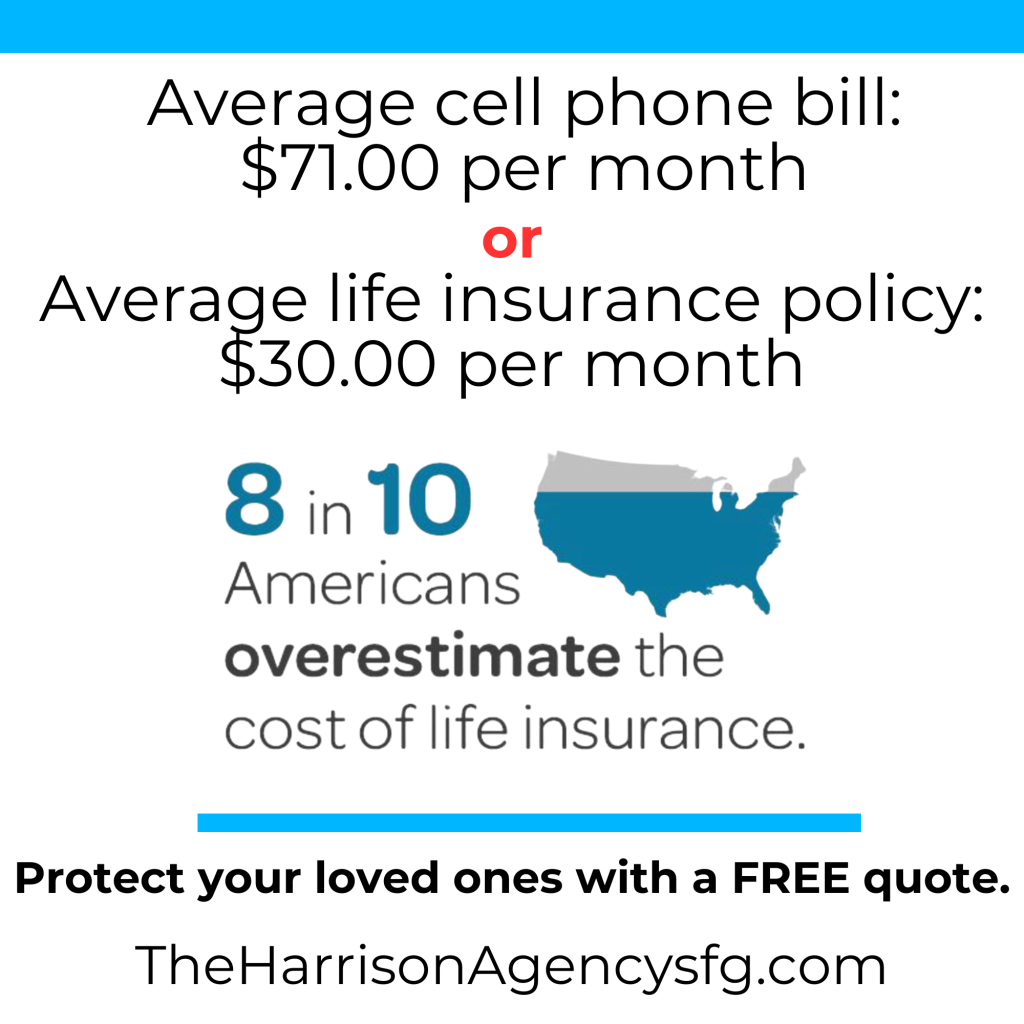

| A Note About Price: It’s Cheaper Than You ThinkHere’s where things get exciting. As the owner for The Harrison Agency, I work with over 30 carriers like Transamerica, Gerber Life, Americo, Fidelity, and Mutual of Omaha. This means I can find the policy that perfectly suits your needs AND your budget. Getting a quote is free, easy, and it means taking that first step toward providing peace of mind. |

Let’s Change the Narrative

No one likes to think about death. But here’s the thing about love: it makes us act, even when it’s hard. Life insurance isn’t about pessimism, it’s about preparedness. It’s about giving yourself the gift of knowing that your family can carry on if the unthinkable happens.

Don’t let GoFundMe become your safety net. Let The Harrison Agency help. Contact us for your no-cost, confidential consultation. We’ll work tirelessly to find the coverage that lets you protect what you love the most.

Email: robertharrisonsfg@gmail.com